HOMEOWNERSHIP PROGRAM

Housing Choice Voucher clients have an opportunity to access resources to help them become home owners. The Housing Choice Voucher (HCV) Homeownership program allows first-time homebuyers to use voucher assistance toward the purchase of a home. HCV families who are able to secure a mortgage loan based on income, credit and debt are eligible to participate in this rewarding program. The program also provides a first-time homebuyer training course that educates them on financing, property taxes and insurance, the role of the title company and homeowner responsibilities.

DHA IS PROUD THAT IT ASSISTED 86 FAMILIES TO BECOME FIRST-TIME HOMEOWNERS IN 2017

The Housing Choice Voucher program provides the opportunity for participants to exchange their housing choice voucher for a homeownership voucher.

The Housing Choice Voucher (HCV) Homeownership Program was created by HUD to assist low-income, first-time homebuyers in purchasing homes. Through the Homeownership option, a public housing agency may provide voucher assistance for an eligible family that purchases a dwelling unit for residence by the family.

To participate in the HCV homeownership program, the HCV family must meet specific income and employment requirements (the employment requirement does not apply to elderly and disabled families), be a first-time homeowner as defined in the regulation, attend and satisfactorily complete the pre-assistance homeownership and housing counseling program required by the PHA, and meet any additional eligibility requirements set by the PHA.

For the purposes of this program, a first-time homebuyer is defined as:

- A single parent or a displaced homemaker who, during the preceding three years, was married and, while married, owned a home with his or her spouse, or lived in a home owned by his or her spouse.

- A family that includes a person with a disability, in which any member has owned a unit during the preceding three years, but for which the PHA determines that the use of the homeownership option is necessary as a reasonable accommodation to make the program accessible to the family.

If you are a participant in the DHA Housing Choice Voucher program and you would like more information about the Homeownership Voucher program, please notify your Leasing Professional at DHA.

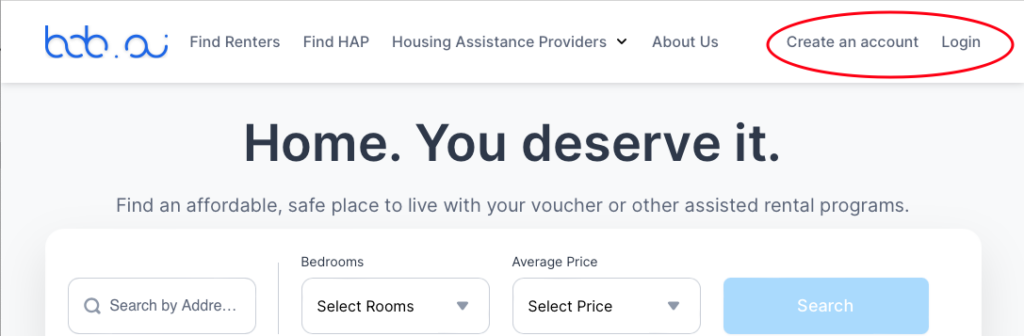

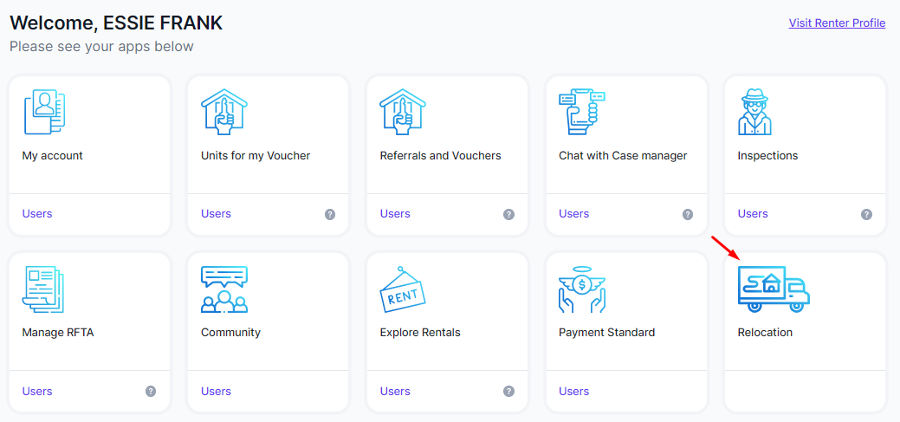

If you are a participant in the DHA Housing Choice Voucher program and you would like more information about the Homeownership Program, please share your information with us here: